What You Should Know

- The News: A new KLAS Research report, Value-Based Care Enablement Services 2026, evaluates the firms helping healthcare organizations transition from fee-for-service to risk-based models.

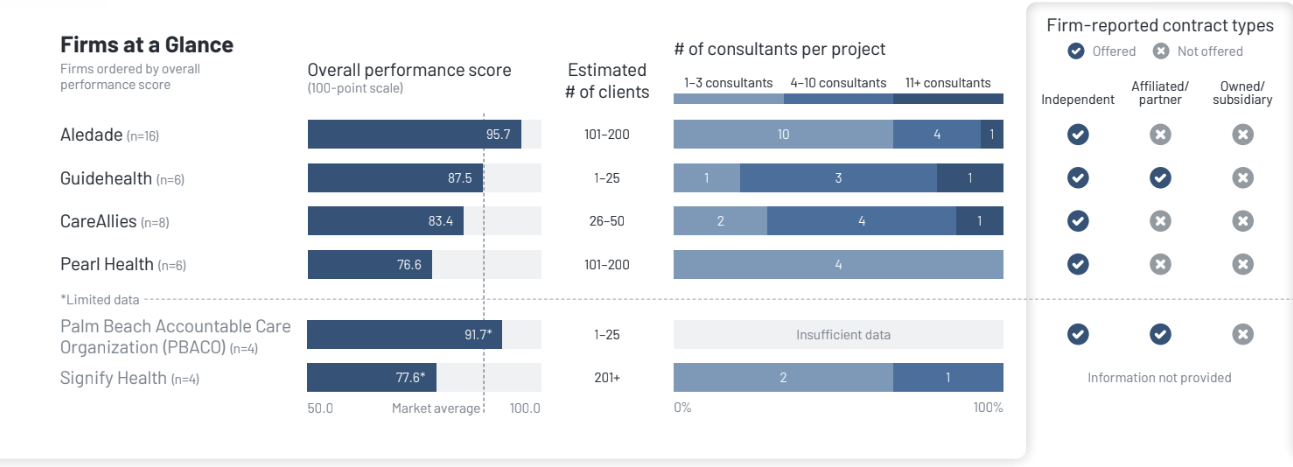

- The Leaders: Aledade (95.7 score) and Guidehealth (87.5 score) top the performance charts, praised for their ability to operationalize insights and drive tangible financial results.

- The Divide: The report reveals a sharp split in satisfaction. While ambulatory practices are aggressively adopting risk models, many acute care organizations remain cautious. Furthermore, firms like Signify Health are struggling to prove their financial worth to clients due to “unclear accountability” and lack of proactive support.

The “High-Touch” Advantage: Aledade and Guidehealth

The report identifies a clear correlation between “hands-on support” and high performance scores.

Aledade emerged as the clear market leader with an overall performance score of 95.7. Clients consistently praised the firm’s “hands-on support model” and technology that simplifies care-gap management. Crucially, Aledade’s success lies in its ability to “operationalize insights”—connecting the data directly to clinical workflows so doctors don’t miss incentive opportunities.

Guidehealth also performed strongly (87.5), with clients attributing success to the firm’s “deep operational expertise” and agility in adopting risk models.

The lesson for 2026 is clear: Technology alone is insufficient. The winning firms are those that wrap their software in a layer of deep, consultative service.

The Analytics Trap: Data Without Direction

Conversely, the report highlights the dangers of vendors that provide data without a compass.

Signify Health struggled in this year’s rankings (77.6), with most interviewed clients expressing dissatisfaction with financial results. The complaint was consistent: the analytics were “broad but insufficiently actionable,” leaving providers unsure how to actually improve contract performance.

Similarly, while Pearl Health received praise for its intuitive technology and identification of savings , clients expressed a desire for the firm to be “more consultative”. In the high-stakes world of downside risk, a dashboard isn’t enough; organizations need a navigator.

The Ambulatory Aggression

One of the report’s most interesting findings is the divergence between ambulatory and acute care strategies.

Ambulatory organizations are taking an aggressive stance on Value-Based Risk (VBR). Because their daily work directly influences preventive care and chronic disease management, they are more willing to enter risk-based arrangements. They are using enablement firms to handle the heavy lifting: patient-level cost prediction, financial forecasting, and contract tracking.

Acute care organizations, by contrast, are more conservative. They are focusing on “building population health infrastructure” and aligning provider groups before taking the plunge into financial risk.

For information about the KLAS report, visit https://klasresearch.com/report/value-based-care-enablement-services-2026-customer-validations-of-firm-offerings/1736