Long-term care can be expensive, and without the right planning, it can quickly deplete a loved one’s savings. Medicaid can help cover these costs, but qualifying for it comes with strict rules and limits on income and assets. Medicaid planning helps families navigate these rules, protecting a loved one’s property while making them eligible for benefits. By planning ahead, you can secure care, preserve savings, and avoid common mistakes that can cost time and money.

How Medicaid Works in New York

Medicaid is a federal health program that provides health care coverage to low-income adults, children, senior citizens, disabled individuals, and pregnant women. It is administered by the New York state government in accordance with federal rules and regulations, and is jointly funded by both the federal and state governments.

Medicaid is often confused with Medicare. While Medicare provides assistance to individuals who are aged 65 or older, or those with disabilities, Medicaid can help low-income individuals of all ages. The differences between the two programs can be seen in their eligibility criteria, coverage, and administration:

Eligibility: Medicaid is available to anyone of any age who has limited income, or who is disabled or blind. But there are income and asset limits. Meanwhile, most people cannot access Medicare until they reach age 65 (although younger people with certain conditions or disabilities may be able to use it).

Coverage: Medicaid can pay for expenses that Medicare does not, including nursing home care, transportation to and from medical appointments, in-home care, and more.

Administration: Medicare is operated entirely by the federal government. Conversely, Medicaid is a joint federal-state program. It therefore helps to have an attorney who understands, for instance, the unique ways in which New York administers Medicaid.

Key Strategies for Medicaid Planning

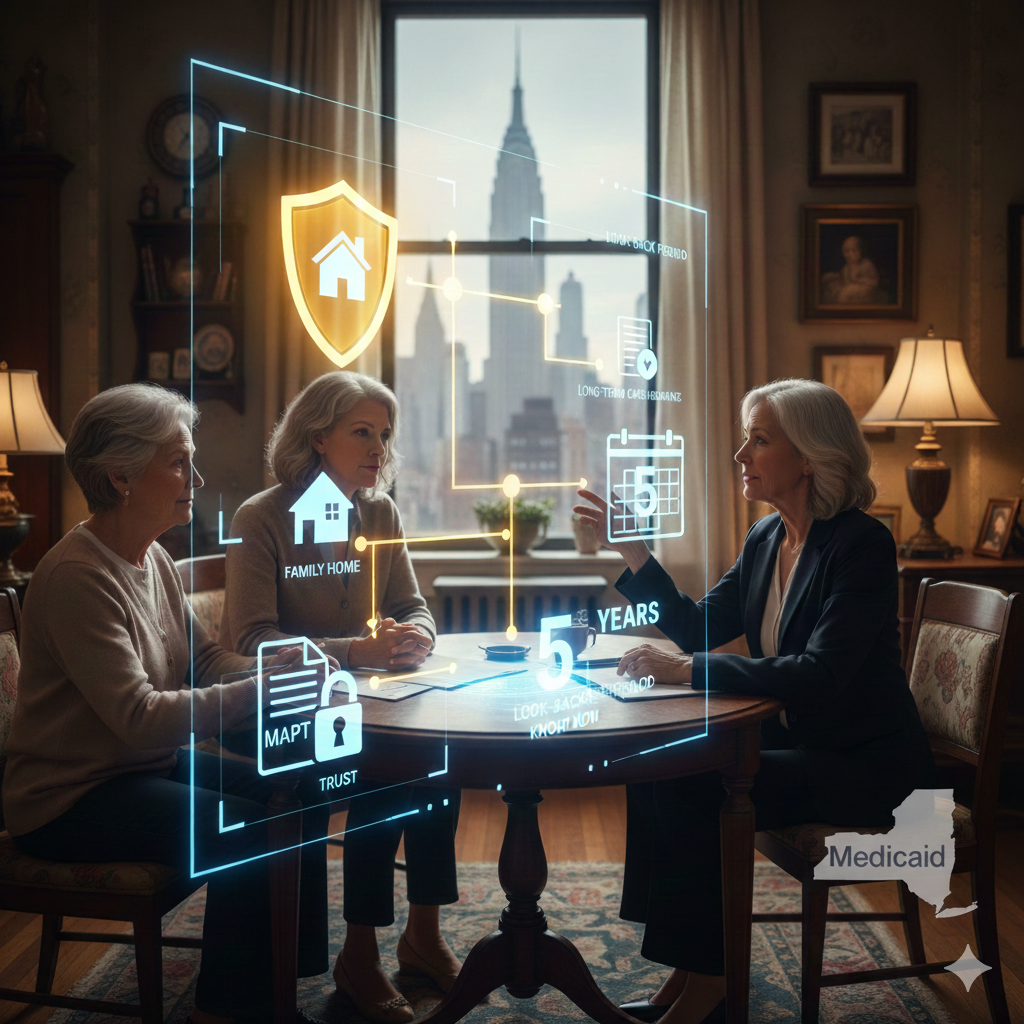

Due to asset and income limits, the main objective of Medicaid planning is to protect a person’s property while helping them qualify for Medicaid. In other words, when done correctly, an individual does not have to liquidate or deplete everything they own (or even their most significant assets) to become eligible for the program. There are various strategies that can help a person do this, including:

Trusts: Known more specifically as a Medicaid Asset Protection Trust (MAPT), this is the centerpiece of Medicaid planning. MAPTs are irrevocable trusts that exclude certain assets from eligibility considerations and therefore preserve the property from having to be liquidated in order to meet the strict requirements of Medicaid.

Gifting: Another strategy is to give away assets or income to reduce the number of resources that are counted against a person who needs Medicaid. Importantly, however, there are rules and regulations surrounding this approach. It’s vital that you work with an attorney to implement this strategy.

Long-term care insurance: This type of insurance can not only protect one’s assets and income, but it can also provide for in-home care. Whereas a Medicaid trust is also important for shielding assets, long-term care insurance can help pay for a person’s medical care while also allowing them to remain in their own home (rather than live in a nursing home facility).

Annuities: Medicaid annuities are contracts between insurance companies and people. An individual who has too many assets for Medicaid can use an annuity to qualify. It involves purchasing a lump-sum annuity and receiving equal amounts of monthly payments while preserving eligibility for Medicaid.

Caregiver agreements: This approach transfers money to relatives who can, in turn, provide in-home long-term care. To ensure that assets and income are not counted against a person, they must enter into a carefully drafted agreement with appropriate terms and conditions.

The ultimate aim of these and other strategies is to allow a person to qualify for Medicaid while preserving their property. Having an experienced Medicaid planning attorney is essential.

Families are often especially concerned about what will happen to the family home. A common question is whether qualifying for Medicaid could result in a Medicaid lien on house or other real property. In New York, the answer depends on factors such as who owns the home, who is living in it, and when any transfers were made, which is why individualized legal advice is so important.

The Medicaid 5-Year “Look Back”

Timing is critical when it comes to Medicaid planning. The reason that many families wait too long to plan for their loved one’s long-term needs is that they don’t consider what is known as the lookback period.

When an individual in New York applies for Medicaid nursing home services, the local Department of Social Services (DSS) will look back five years and review the assets and income the applicant owned. Any property that is transferred within this five-year period will still count against the applicant when determining eligibility.

Why Professional Guidance Matters

By retaining legal counsel early, you can avoid some of the most common mistakes that people make when it comes to planning for long-term care. These include:

Using trusts incorrectly: Trusts have to be structured properly to preserve Medicaid eligibility. For instance, a revocable trust would not shield an asset because it is still considered the property of the grantor (the person who creates the trust). Careful drafting of the trust is indispensable, and an experienced lawyer can assist you.

Non-compliant gifts and transfers: Before you decide to give away or transfer any property so you can qualify for Medicaid, you should know that doing either of these incorrectly can cause more harm than good. An attorney can guide you on the rules that attach to these gifts and transfers and help ensure you do them the right way.

Waiting too long: Remember, a Medicaid applicant must consider the five-year lookback period and plan well in advance to avoid penalties that come with waiting too long. The right law firm can devise a comprehensive plan for you and your family now so you can meet the long-term care challenges that will arise later.

Elder law attorneys are experienced with the above and other common issues that people encounter when planning their own or their loved one’s Medicaid and nursing home care needs. Working with the right lawyer can avoid costly mistakes and protect more of your family’s assets.

The Best Time To Start Medicaid

Planning is Now Life is uncertain. Health problems can suddenly appear. A disability can strike without warning. Financial and economic instability, plus the ongoing threat of inflation, are persistent issues. The time to get ready is now. Secure your financial future today by contacting a New York Medicaid planning attorney who can review your unique circumstances and develop a personalized strategy.