What You Should Know:

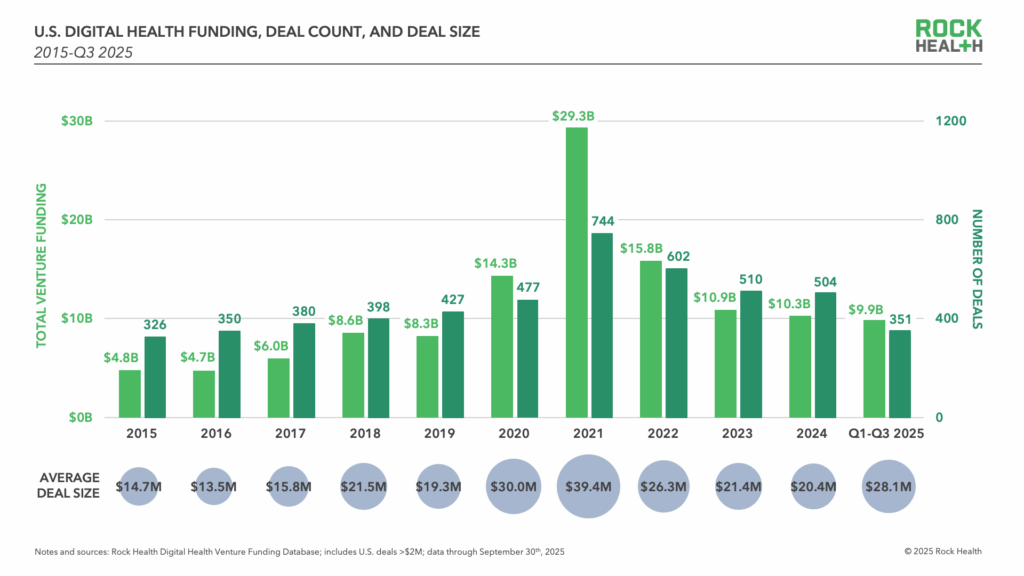

– The U.S. digital health sector saw $3.5B in venture funding across 107 deals in Q3 2025, contributing to a year-to-date total of $9.9B, according to Rock Health’s Q3 2025 report. While this pace surpasses 2024’s total through Q3, the apparent steadiness belies significant underlying market shifts.

– Dynamics once considered temporary—such as unlabeled funding rounds and highly uneven fundraising timelines—have solidified into permanent features of the market, forcing companies and investors to make every decision count.

I. Capital Concentration and Blurring Benchmarks

Mega Deals Dictate the Digital Health Market Map

Mega deals (rounds of $100M+) have been the defining force of 2025. Nineteen such financings have closed this year, already surpassing the full-year 2024 count. These outsized rounds—including investments in Strive Health ($550M), Judi Health ($400M), and Inspiren ($100M)—account for 39% of total funding. This concentration funnels dollars into a narrow set of companies and reinforces the dominance of mega funds, with nearly 80% of mega deals this year having a mega fund on the term sheet.

The Normalization of Unlabeled Raises

What started as a market stopgap has become routine: 35% of 2025’s financings remain unlabeled. While unlabeled rounds offer startups a pragmatic way to extend runway and delay valuation haircuts, they weaken traditional benchmarks and create a “noisier pipeline” that is harder for enterprises to assess for readiness and long-term partnership potential.

The Thinning Series B Pipeline

The fundraising velocity trend is highly uneven. While the median time between most funding rounds (e.g., Seed to A) fell in 2025, the time between Series A and Series B significantly lengthened to a median of 27 months, up from 17 months in the 2023 cohort. Coupled with a thinning deal flow (just 30 Series B raises through Q3 2025, down from over 60 annually in prior years), this signals that the path to converting early traction into scalable growth has become far less direct.

II. The Workflow Race: Startups Go Horizontal, Incumbents Double Down

Activity is overwhelmingly clustered around workflows and infrastructure, which now offer the clearest path to differentiation. Clinical workflow and non-clinical workflow are 2025’s two most-funded value propositions, capturing a $1.3B lead over the rest of the field.

Startups Push for Horizontal Breadth

Rock Health reports that digital health startups are using funding, partnerships, and M&A to build horizontal breadth and evolve from point solutions into comprehensive platforms. M&A deal volume is up 37% from last year, with 166 acquisitions logged so far.

- Examples: Judi Health acquired care navigator Amino Health to push into patient navigation, and the acquisition of EHR and workflow assets now represents the largest share of 2025 deals (16%).

- Differentiation: To stand out, startups are publishing ROI data, forming joint ventures with health systems, and tailoring their models for specific specialties, signaling traction before incumbents reset the baseline.

Incumbents Reset the Baseline in Digital Health Market

Incumbent EHR vendors are rapidly integrating once-differentiating startup workflows into their core systems, accelerating the market reset.

- Epic is folding clinician support (Art), revenue cycle automation (Penny), and patient-facing AI (Emmie) into its EHR.

- Oracle is following suit with an AI-enabled patient portal and revenue cycle suite.

- Innovaccer is launching Gravity, an AI-first conductor designed to route models and data across a common platform.

Click here to view Rock Health’s Q3 2025 Digital Health Funding report.